Are you curious about how food stamps work in Oklahoma? Food stamps, also known as SNAP (Supplemental Nutrition Assistance Program), help people with low incomes buy food. Figuring out how much help you’ll get depends on a few things, and it’s not always straightforward. This essay will explain the basics of how the SNAP program works in Oklahoma and help you get a better idea of how much food stamps you might receive. We’ll break it down so it’s easy to understand!

Who’s Eligible for Food Stamps in Oklahoma?

First things first, you need to know if you even qualify. The Oklahoma Department of Human Services (DHS) handles SNAP. They look at your income, the number of people in your household, and certain expenses you might have. Generally, you need to meet some income and resource limits. These limits change from year to year, so the exact numbers will vary.

To be eligible, you typically need to be a resident of Oklahoma and a U.S. citizen or a legal immigrant. There are a few exceptions to this rule. If you are not a U.S. citizen, then to be eligible, you must meet specific citizenship requirements. Generally, you need to be a legal resident of the United States to apply for SNAP benefits. Also, you usually need to provide some form of identification, like a driver’s license or state ID card.

Let’s be clear. Your income matters the most. The lower your income, the higher your chances of getting SNAP. Also, the size of your household affects your benefits. A larger household usually gets more SNAP benefits than a smaller one, since they need to feed more people. Remember that DHS assesses these factors, and there are many specific rules involved.

Here are some of the general guidelines:

- U.S. Citizenship or eligible non-citizen status

- Oklahoma Residency

- Income Limits

- Resource Limits

How is My Income Verified?

DHS needs to confirm how much money you make and where it comes from. This is called income verification. It can include pay stubs, tax returns, bank statements, and information about other sources of income, like unemployment benefits or Social Security.

They will review all of the information you provide. DHS needs to make sure that you are reporting your income accurately. Providing false information can lead to penalties. The agency also reviews certain assets you may have. If you have savings accounts or own valuable property, this might affect your eligibility.

DHS will often do this through a review of your documents and your bank accounts. It’s important to note that they do not have the right to view your personal bank accounts at any point in time. You will be required to give them documentation such as bank statements, pay stubs, and tax information. DHS will use this information to establish your income and resources.

DHS uses a method to verify income, resources, and other information. Here’s a quick rundown:

- Document Review: Examine pay stubs, bank statements, and tax returns.

- Wage Verification: Check with employers to confirm reported wages.

- Asset Checks: Verify the value of assets like savings accounts.

- Third-Party Sources: Contact other agencies for benefit information.

What About My Household Size?

Your “household” is everyone who lives with you and buys and prepares food together. This is an important factor when deciding how much SNAP you will get. Your benefits will be higher if you have more people in your household. This is because you have to feed more mouths!

To figure out household size, the DHS will ask you questions about who lives in your home. They’ll need names, dates of birth, and sometimes even social security numbers. Once they’ve assessed your household, they will be able to determine a benefit amount.

In order to be considered part of the same household, people usually have to share living and food expenses. There are some exceptions, such as when people are renting a room in a shared household, but for the most part, everyone in the household will be considered for benefits. For example, a couple who lives together will be considered part of the same household, even if they aren’t married. If someone is using a separate kitchen and purchasing food separately from other individuals in the household, they would likely be considered their own separate household for SNAP eligibility purposes.

It’s important to report everyone accurately. This ensures that you’re getting the correct amount of SNAP benefits. If your household size changes, you should notify DHS, so they can adjust your benefits.

Are There Any Deductions from My Income?

Yes, there are. When calculating your SNAP benefits, DHS allows for certain deductions from your gross income. These deductions can lower your countable income, which in turn, can increase your benefit amount. This is great news, as it means you could get more help.

One of the most common deductions is for housing costs. This includes rent or mortgage payments. Another common deduction is for medical expenses, if you have them. You also might be able to deduct child care costs if you need them to work or go to school. These deductions help to lower your income.

You must provide proof of these expenses in order to receive the deduction. Keep receipts for all of these things. Make sure you understand which expenses qualify. Your DHS caseworker can help you with this process. Be sure to keep records of all of your expenses in order to ensure that you are able to receive as many deductions as possible.

Here’s a simple table showing some common deductions:

| Deduction Type | Description |

|---|---|

| Housing Costs | Rent, mortgage, property taxes, etc. |

| Medical Expenses | For the elderly or disabled |

| Child Care Costs | Needed for work or school |

| Child Support Payments | Court-ordered payments |

What Happens After I Apply?

Once you’ve applied for SNAP, DHS will review your application. They may interview you over the phone or in person. They will also ask you to provide documentation. After reviewing all the information, DHS will let you know if you are eligible. They will then calculate your benefit amount.

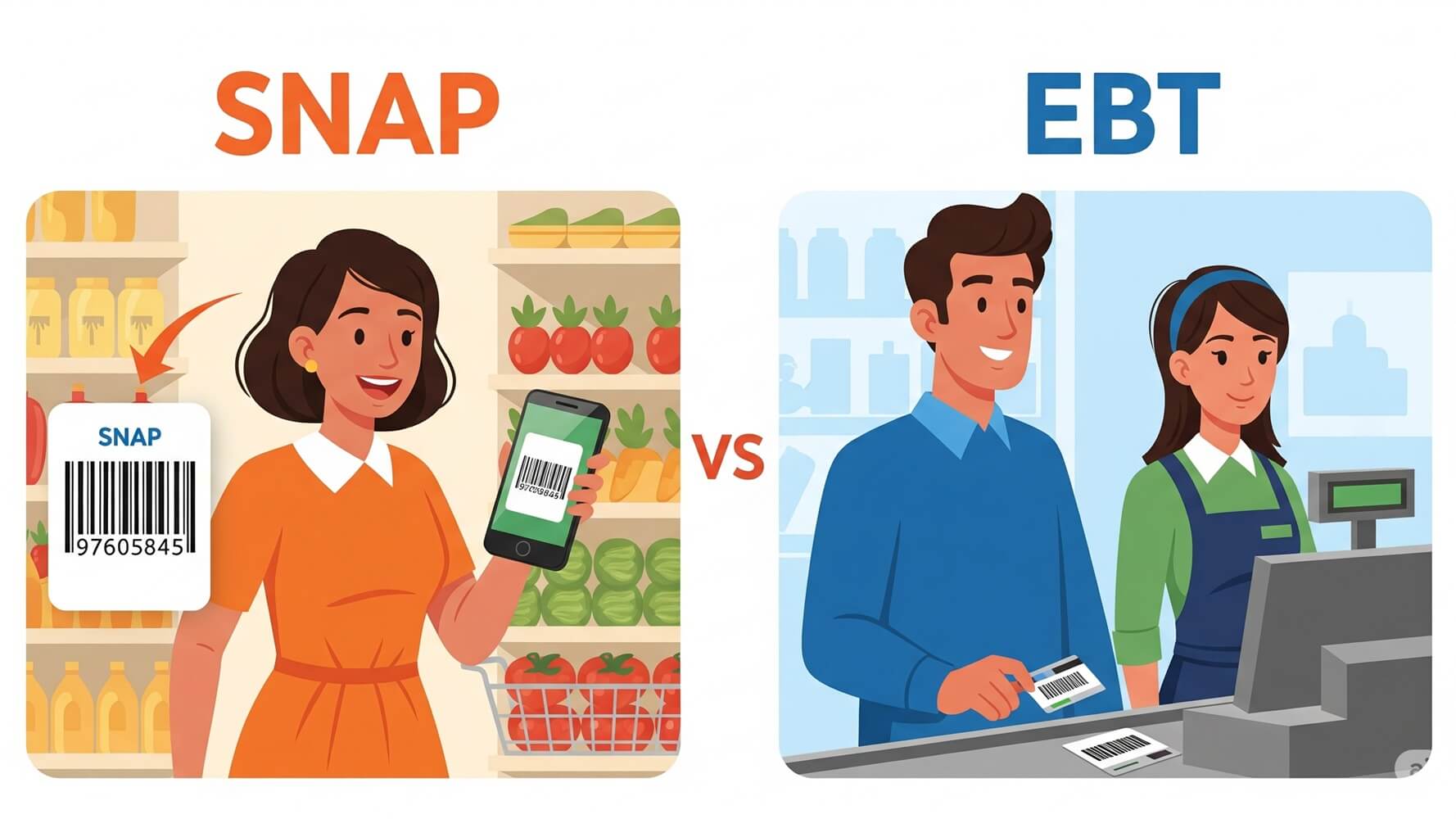

The process might take a few weeks. DHS can explain the specifics of how to receive your benefits. They will also tell you the amount you will receive and when to expect it. If you are approved, your SNAP benefits will be loaded onto an EBT card. This works just like a debit card. You can use it to buy groceries at approved stores.

It’s important to cooperate with DHS throughout the application process. Provide accurate and complete information, and respond to any requests for information. If there’s a problem with your application, you have the right to appeal the decision.

Here is a quick rundown of the steps after you apply:

- Application Review

- Interview

- Documentation Requests

- Eligibility Determination

- Benefit Calculation

- Benefit Issuance

What Can I Buy With My Food Stamps?

You can buy a lot of different food items with your SNAP benefits! This includes groceries like fruits and vegetables, meat, poultry, fish, dairy products, and bread. You can also buy seeds and plants to grow your own food. The goal is to help you get healthy food.

SNAP benefits are not meant for everything. You can’t buy things like alcohol, tobacco, pet food, or non-food items like cleaning supplies or hygiene products. You also cannot use SNAP to pay for hot foods that are ready to eat in a store, unless you are disabled, elderly, or homeless.

SNAP is intended to provide nutritional assistance. There are specific restrictions that are intended to help with this goal. SNAP benefits can only be used at authorized stores, which display a special sign. You can’t use your card at any store. There are many locations that accept SNAP benefits, including grocery stores and some farmers’ markets.

Here is a quick rundown of what you can and cannot buy:

- Can Buy: Fruits, vegetables, meat, poultry, fish, dairy products, bread, seeds, and plants for food.

- Cannot Buy: Alcohol, tobacco, pet food, non-food items, and hot prepared foods (generally).

How Much Food Stamps Will I Get in Oklahoma?

The amount of food stamps you get in Oklahoma depends on your household’s income, the number of people in your household, and certain expenses that are deductible. It’s calculated using a formula that the federal government sets up, with a few Oklahoma-specific rules.

To give you a rough idea, the maximum SNAP benefit amounts change every year based on the size of your household. These are the maximum benefits only. Many people will receive less than the maximum. You can find this information on the USDA website or from your DHS caseworker.

Remember that this is not an exact amount and it is just an estimate. The actual amount will be determined by the state, based on all of the things we’ve talked about. The best way to find out how much SNAP you may receive is to apply for SNAP benefits in Oklahoma and go through the process.

To give you some very rough idea, here’s an example (remember, these numbers change):

- Household Size: 1 person.

- Income: Below a certain limit.

- Benefits: Could be up to a maximum amount (e.g., $291 per month, though this is an example and might be different).

Conclusion

So, there you have it! Getting SNAP benefits in Oklahoma involves looking at things like your income, household size, and certain expenses. While it might seem complicated, DHS is there to help. If you think you might be eligible, applying is the best way to find out. Just remember to be honest and provide all the necessary information. Good luck!